Kainga Ora Staff Information

This information is for Kainga Ora staff when referring clients to Good Shepherd NZ.

Good Loans

Good Loans are for people who can afford to make small repayments to repay a loan for an essential item.

Please Note: Single people receiving a job seeker benefit are currently not eligible for a Good Loan.

Clients must:

– Be able to afford the basics like rent, food, power and petrol

– Be up to date with their bills and debts

– Have a small amount leftover to make repayments

How much will they need to repay?

We won’t be able to provide a Good Loan to clients who:

– Are looking for cash loans, or to pay family, or to go on holiday

– Are behind on their rent, power or other basics already

– Are on the Jobseeker benefit

These budgets are simplified to show the need for capacity to repay. Loan applications will include all liabilities and consider all spending from the previous three months.

IMPORTANT: This is a loan programme, rather than assistance. The ability to repay is a fundamental component of this programme. Complex budgets with multiple debts may be most suitable for a financial mentor referral in the first instance.

The client journey

When someone contacts us, we have a brief conversation to outline how the process works and ensure people are eligible (income, residential).

We begin the application process by gathering documents that can provide evidence of someone’s financial situation.

We do this to meet Responsible Lending guidelines and to make sure repaying a loan is within someone’s capacity.

The completed application is then assessed by our lending assessment team to make sure repaying a loan is realistic and appropriate. If the loan is approved, we pay the supplier of the item directly.

Useful pages to provide to your clients

To explain this process to clients we have created the page ‘What to expect’. We use this information to summarise their budget, and ask them about the one-off or irregular income and expenses, to make sure we are covering everything. Most people provide their statements electronically using CreditSense.

Referring your clients for support

Good Loans Application

- Clients can contact us directly to apply for a Good Loan by going to the enquiry page. The application is completed over the phone and using email.

- For clients who require face to face support, some financial mentors can support clients to complete a loan application. (link to list)

Find a financial mentor

Clients that don’t yet have the capacity to make repayments should work with a financial mentor first. Mentors can be found via the Money Talks website.

Financial mentors can support people to get on top of their finances, and create a surplus that would allow them to repay a loan.

Debt Solutions

We may be able to help people struggling with their debts, through debt coaching and a debt solution loan.

We may be able to help people who:

– Have high-cost debt that has become unmanageable

– Are ready to voluntarily commit to working with a coach to get on top of their financial challenges

Economic Harm

We have a service dedicated to supporting people to address economic and financial abuse, as a form of family violence. This is a small service that is oversubscribed, and most referrals usually come through family violence services. Family violence agencies are best placed to assess safety first before we begin providing financial support.

Our service can help:

– Negotiate with creditors to reduce repayments, write off debts or come up with new repayment arrangements

– Support to access family violence hardship provisions

– Advocate directly with creditors, banking ombudsman and others

– Provide a safe environment to work through the complexities of economic harm

– Help gain more financial independence and control of your finances

FAQ

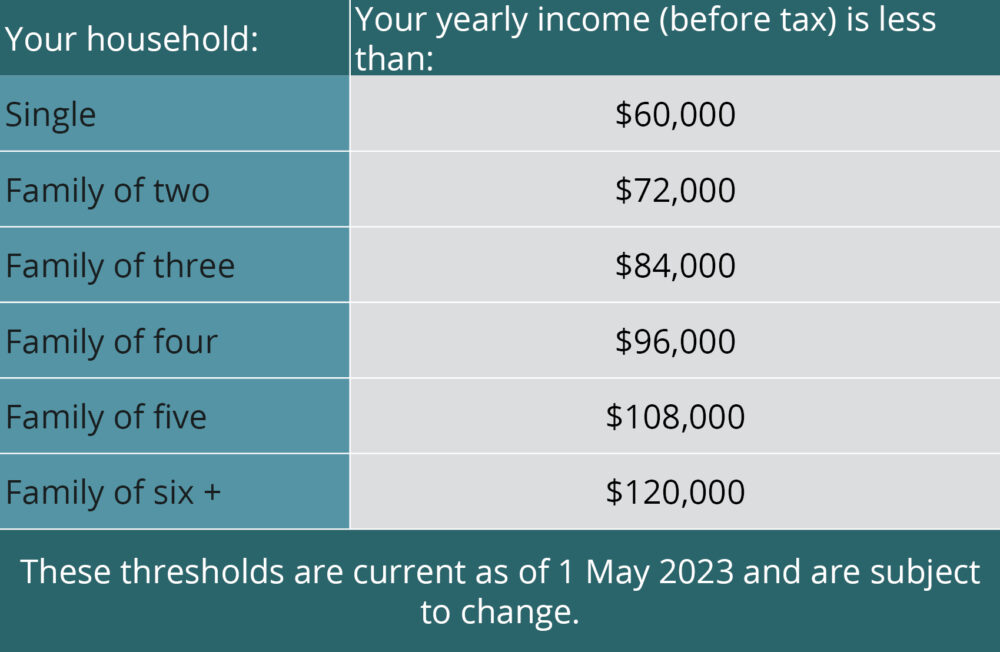

We can help citizens, residents, and people on work and student visas. Our clients must earn within the current income thresholds for people we can help.

Essential items and services like:

- Second-hand cars

- Car repairs

- Dental work

- Devices

- Household appliances

- Medical costs

- Veterinary costs (own pet)

- Funeral costs

- Education

- Payment of debts or bills in arrears is possible only through a DEBTsolve Good Loan

- Holiday

- Christmas expenses

- Fines or penalties

- Cash

- Visa application fees

- Church tithing

- Business purposes

- Regular and essential living expenses

- Overseas or domestic travel

- Caravans and portable cabins as a dwelling (permanent homes)