Our DEBTsolve programme will help you take control of your unmanageable debt.

Our specialist Financial Wellbeing Coach will work with you to understand your situation and create a plan that will help you get on top of your debt.

Our free DEBTsolve programme combines Financial Wellbeing Coach, advocacy and debt solution loans of up to $15,000 to help with your unmanageable debt.

DEBTsolve

DEBTsolve

DEBTsolve can help you take control of your unmanagable debt.

Debt challenges can be complex, and depending on your situation, can take time and energy to work through.

Our Good Loans Coaches and Financial Wellbeing Advocates can support you with debt coaching, information and advocacy. In some cases, we may be able to provide a debt solution loan of up to $15,000, to help with high-cost, unmanageable debt.

DEBTsolve is not a quick fix, but our Coaches and Advocates are dedicated to supporting you to reach your financial goals.

Scroll down for more information before making an enquiry.

We are experiencing high demand and it may take several days for our team to get back to you.

Please note:

We provide loans for essential items, but not for cash, vacations, or normal household bills like food or future rent – Good Loans lending and affordability criteria apply.

If you are a single-person receiving job seeker payments as your main income, we are currently unable to assist with a loan.

If you need urgent financial assistance please contact MSD or go to MoneyTalks to find your nearest financial mentor.

When you commit to DEBTsolve you:

What’s good about DEBTsolve?

Create your own unique financial plan of action

Help negotiating with lenders to reduce your debts and creating manageable repayments

Access to a Good Loan to help with your unmanageable debt

Confidential support from a Good Loans Coach or Financial Wellbeing Advocate

Who is it for?

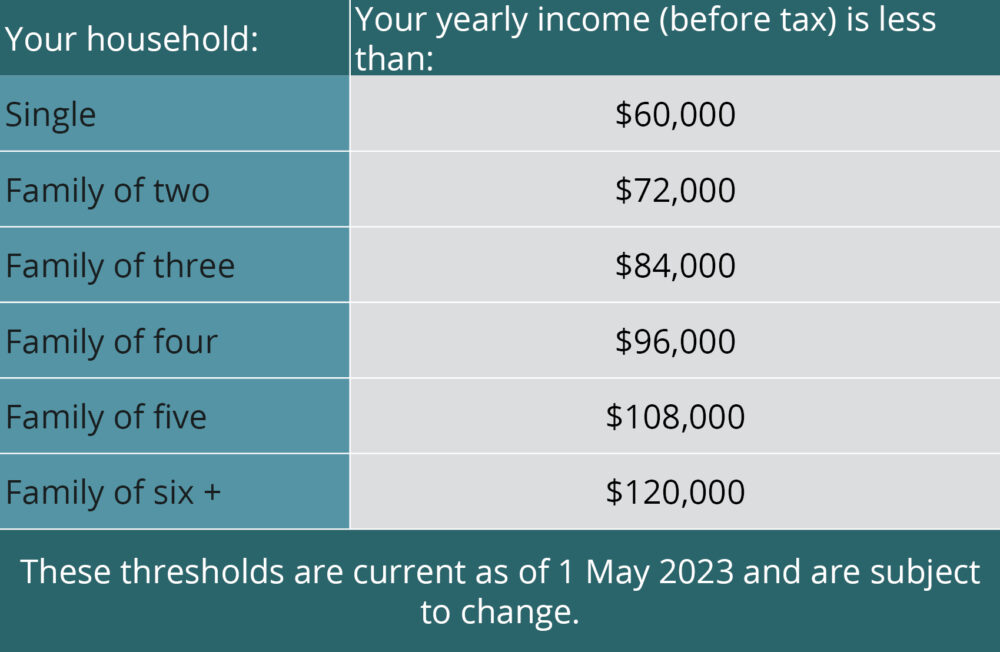

You may be able to access a DEBTsolve Good Loan if your yearly income is less than the amounts listed in the table.

These amounts are a guide only.

These thresholds are current as of 1 May 2023 and are subject to change.

How it works:

1. Speak to one of our friendly team

2. Connect with your Good Loans Coach

3. Create a financial plan of action

4. Take control of your debts

Take the first step to regain control of your unmanageable debt.

“The stress of not having money is really really hard. DEBTsolve gave me hope when I had none. “I feel fantastic. I still can’t believe it”.

- Hannah, DEBTsolve client

Read client story

How much will I need to pay?

About Good Loans

Good Loans are no interest loans focused on your long term financial wellbeing.

They’re designed to help you access essential items and services like a second-hand car or medical bill

To make an enquiry please complete one of these forms:

Client rights and responsibilities

Good Shepherd New Zealand and the community organisations who work with us to deliver DEBTsolve and Good Loans, take your rights very seriously.

Read about what you can expect from us and what we expect from you.

Additional information

Good Loans and DEBTsolve terms and conditions

Terms and conditions summarises important information relating to your Good Loan.

These form part of our loan offer so we recommend you take some time to read them.

Good Loans and DEBTsolve privacy statement

This explains what happens to your personal information when you enquire about or participate in the Good Loans or DEBTsolve programme.