Verifying your identity and address

Before you can make a Good Loan application, you need to verify your identity and address.

There are three options to verify your identity and address.

Verify electronically

You can verify your identity and address securely and electronically using Centrix SmartID and a smartphone or similar device. You will need a current passport or a New Zealand driver licence.

Once you have completed the Centrix SmartID verification process, Centrix will securely provide a Centrix SmartID report to Good Shepherd Good Loans.

Who are Centrix?

Centrix is a New Zealand-based credit bureau that has been operating since 2009.

Find out more about Centrix

How to use Centrix SmartID

To finish the verification process in one go, make sure you have your current passport or a New Zealand driver licence identification ready, your phone charged and with enough data and time to finish once you have started.

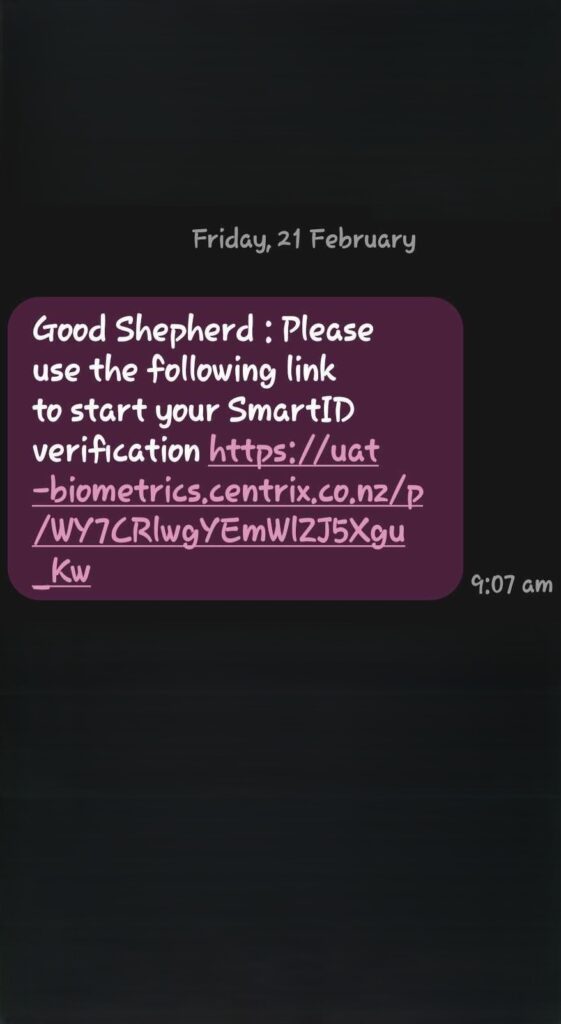

If you agree to using Centrix SmartID, we will send you a text link. Each SmartID link can be used to complete the process only once. If you need to stop part way through you can click on the link later and continue from where you got up to before.

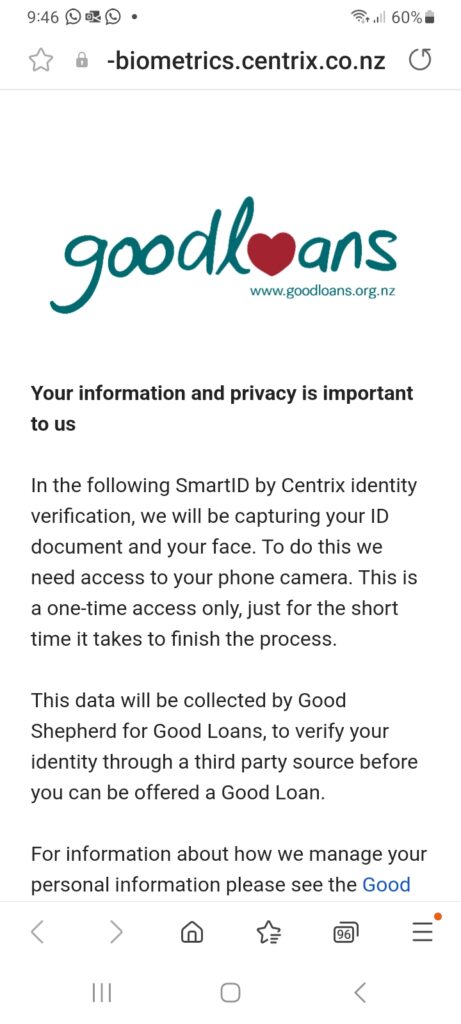

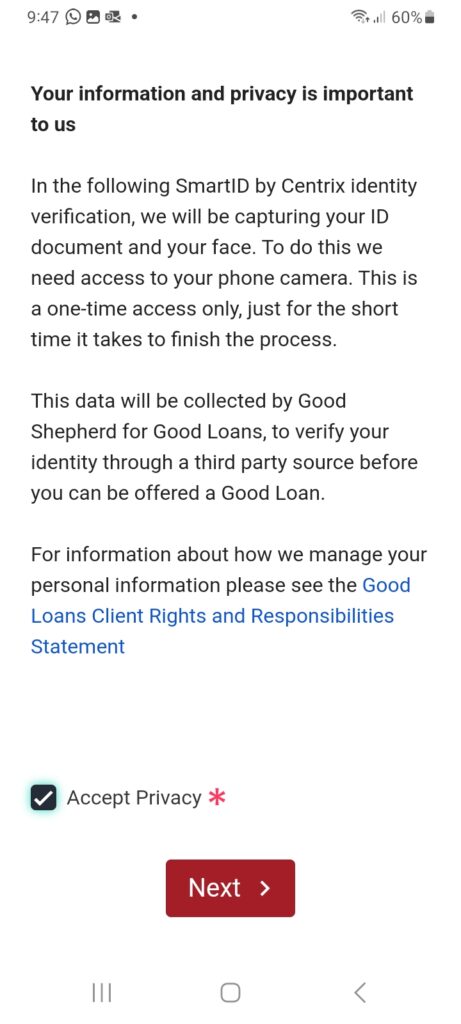

To start – consent to sharing your personal information

We will send you a text link. Click on the link, read the privacy information, and tick ‘Accept Privacy’ if you consent to sharing your personal information.

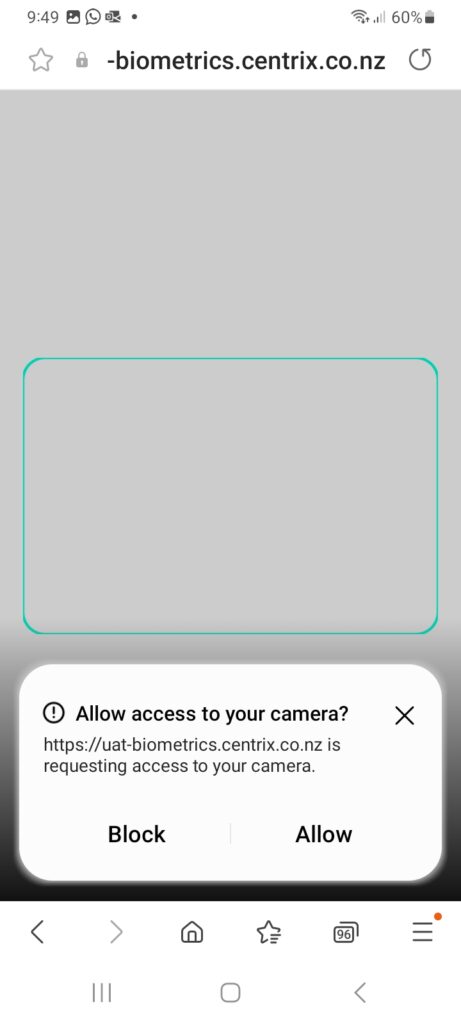

Step 1 – select your ID type and photograph your ID

Select your identification type. Then use your phone camera to take a clear, crisp photo of it without shadows or light.

SmartID reads the photo and records image text like name and date of birth.

Tip

Make sure there are no strong shadows or glare on your face – a poor quality video may mean SmartID can’t identify you.

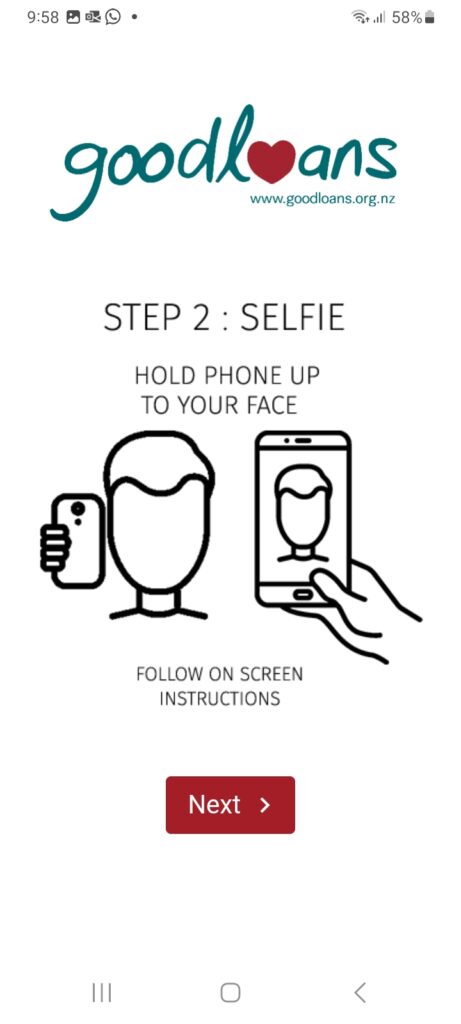

Step 2 – take a video selfie

Take a video selfie with your phone showing a front and side view of your face.

SmartID biometrically matches your video selfie with your identification photo and checks that the information is correct against official data sources.

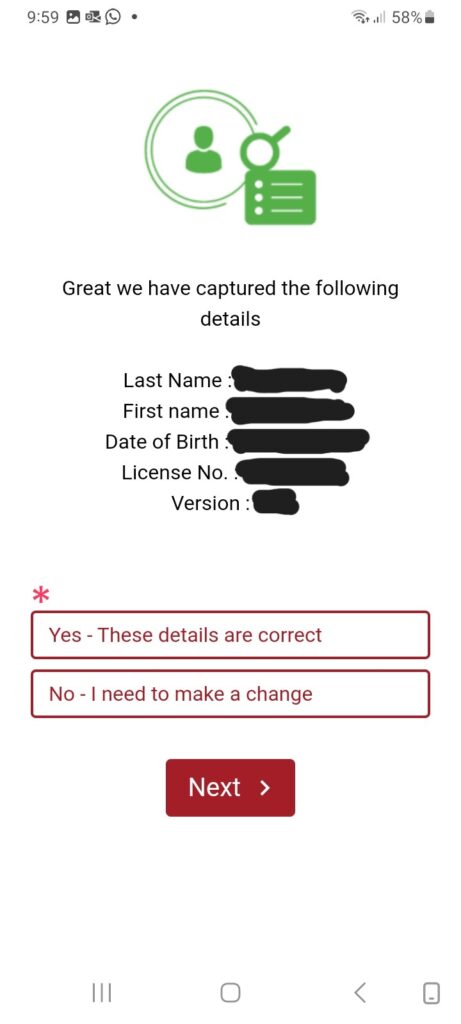

Step 3 – review your personal information

Review your personal details to make sure your first name, last name and date of birth are exactly the same as on your identification. If they do not match, SmartID will not be able to verify your identity.

SmartID checks your name and date of birth against a number of databases to confirm your identity and whether you are a Politically Exposed Person (PEP).

To correct any errors, press “No – I need to make a change”.

Find out more about a Politically Exposed Person (PEP)

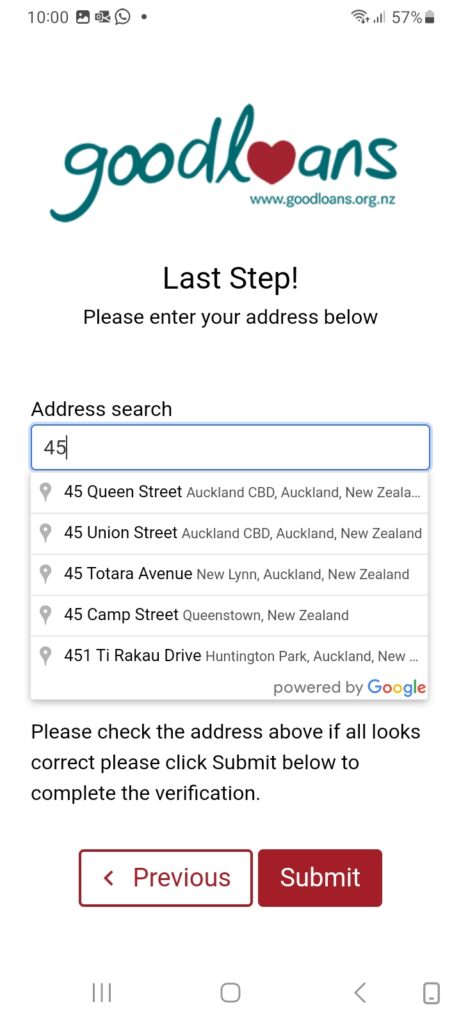

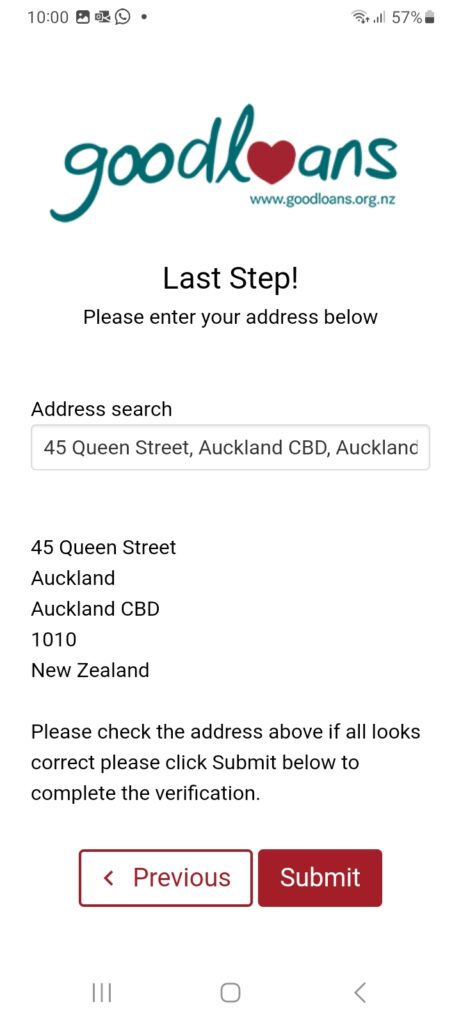

Step 4 – confirm your address

Start entering your current residential address and select the correct address from the options. Press submit to confirm the address is correct.

SmartID checks your address against several databases to verify it as your current address.

What happens when you have finished SmartID

A Centrix SmartID report is provided to your Good Loans Advisor or Financial Wellbeing Coach. They will contact you to continue the loan application process if verification was successfully completed, or to discuss any verification issues.

Tip

If SmartID has verified most, but not all, of your identity and address information, we may have a simple workaround to help you complete the SmartID verification process. Your Good Loans Coach or Financial Wellbeing Advocate will talk you through anything you need to do

Frequently asked questions

What kind of phone/device and phone plan do I need to use Centrix SmartID?

Any smartphone with a front and rear camera and the ability to connect to the internet will be able to do a Centrix SmartID verification. The process can also be completed on a tablet with these features if the texted link can be accessed on that device.

The link can only be sent to a phone number.

How much data does it use to do Centrix SmartID?

The SmartID process can be completed in a few minutes. All you need to do is take a photo of your identification document and record a short video of yourself.

How many times can I use the Centrix SmartID link?

The link is available until accessed. Each link can only be used once. If you partially finish a link and close the page, click the link you were originally sent and will take you back to where you left off. Contact your Good Loans Advisor or Financial Wellbeing Coach if you need them to send you the link again.

How do you access my personal information?

We can only access your personal information with your permission. Centrix SmartID compares your image from your scanned document with your video selfie and against registers such as the Driver Licence database. These are all secure connections to keep your information safe.

Where is my personal information stored and how do I know it is secure?

Your biometric information is held in a secure environment in Microsoft Azure. Your consent gives only Good Shepherd New Zealand access to your information for Good Loans. Microsoft Azure has an excellent security reputation. Centrix has strong security protocols including digital certificates, advanced cryptography, and encryption.

Can other organisations get a copy of my personal information?

No – you have only given Good Shepherd New Zealand consent to access your personal information and we can only use it for the purposes stated in our Good Loans Client Rights and Responsibilities Statement.

How can I protect my personal information from third party access?

Know who you are providing personal information to and the reasons why. Only click on links when you expect to receive them and never reveal your passwords. The privacy information includes who will get access to your personal information and for what purposes. It should be clear and easy to understand.

Can I get a copy of my Centrix SmartID report?

All consumers can request access to the information held about them at a Credit Reporting Bureau such as Centrix. You can also ask your Good Loans Advisor or Financial Wellbeing Coach for a copy.

Verify face-to-face

If you are having a face-to-face appointment with your Financial Mentor to make your Good Loan application, you can verify your identity and address in person. You will need to bring original forms of your identity and address documents to be copied in your appointment.

Documents that can be used to verify your identify

Documents that can be used to verify your identity include:

- A New Zealand driver licence AND a supporting form of identification such as a New Zealand bank statement, a statement from a government agency, or other items from a government agency such as a Community Services Card.

- One form of photo identification such as a New Zealand driver licence, Kiwi Access or 18+ card AND a supporting form of non-photo identification such as a birth certificate or certificate of citizenship.

- One form of primary photo identification such as a passport or firearms licence.

Documents that can be used to verify your address

Documents that can be used to verify your address must have your legal name and current residential address on them, and include:

- A New Zealand driver licence

- A power, gas, water, internet or rates bill

- A government document, a bank document, or insurance policy

- A document from an NZQA registered education provider

- A residential rental agreement

- A letter from your current employer

- Confirmation of other loans

Verify over the phone

If you don’t have a current passport or New Zealand driver licence, you can verify your identity and address over the phone. You will need to:

- Email a head-shot image with your photo identification next to your face, so it can clearly be seen that your face matches the photo on the identification.

- Alternatively, if you attend a loan application appointment via video call, you may hold your photo identification up to your face so a screenshot image can be taken.

- Provide a photo or scan image of the back of your photo identification (unless it is a passport).

- Provide photo or scan images of other appropriate supporting identification and address verification documents.

Find out more about how we protect your privacy.

Find out more about your rights and responsibilities as a Good Loans client.