Three reasons why people end up in debt

August 10, 2021

No one is immune to debt. Whether it’s due to a sudden change or having an income that remains low over a long period of time – debt can happen to anyone.

Before we dive into the different reasons why someone might have debt, it’s worth pointing out that not all debt is bad.

Debt can be necessary. It can help people get out of a tough situation or buy an essential item; like a car so they can get to work.

A simple rule about debt to remember is:

- If it increases your net worth or has future value, it’s considered to be good debt.

- If it doesn’t do that it could become bad debt.

- If you don’t have money to pay for it, it’s unmanageable debt.

Unmanageable debt backs people into a corner, can feel inescapable and can happen easily if one foot is placed wrong.

We explore three different circumstances that can lead to bad debt, how it might feel and possible solutions.

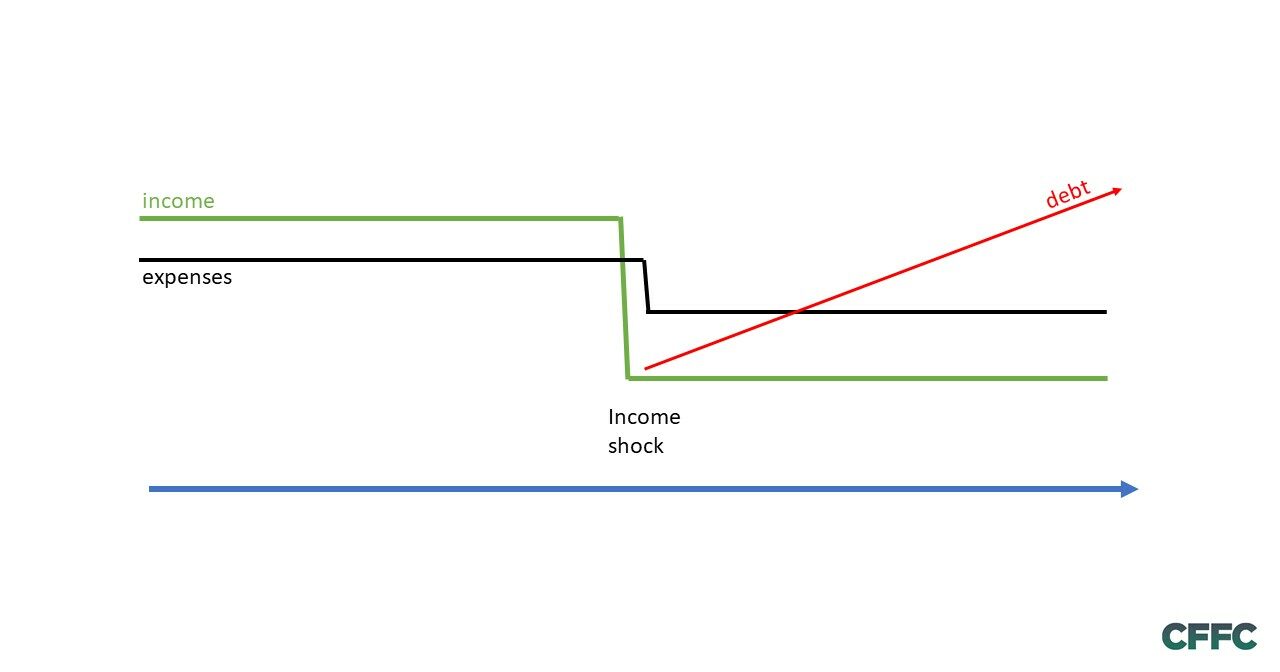

Income shock debt

Losing your job, your business going under or divorce can lead to a sudden decrease in income – income shock.

If you are experiencing income shock, there can often be a feeling of embarrassment or shame, as well as the attitude that it’s temporary and your income will recover soon.

These attitudes and feelings can lead to a delay in seeking help or advice and making the appropriate lifestyle changes – which can result in unmanageable debt.

Although for some people income shock can be temporary and they can recover, research by Te Ara Ahunga Ora Retirement Commission has found since Covid-19 there have been fewer people recovering and more people relying on loans over longer periods of time.

The research also found that people who are experiencing income shock are also more susceptible to get rich quick scams and dishonest business opportunities.

What to do if you experience income shock

- Use a budget tool to work out your finances

- Reduce expenses where possible

- Speak to a financial mentor or budgeting service

- If your debt is now unmanageable, contact our DEBTsolve team

- Avoid quick wins – third-tier lenders or get rich quick schemes

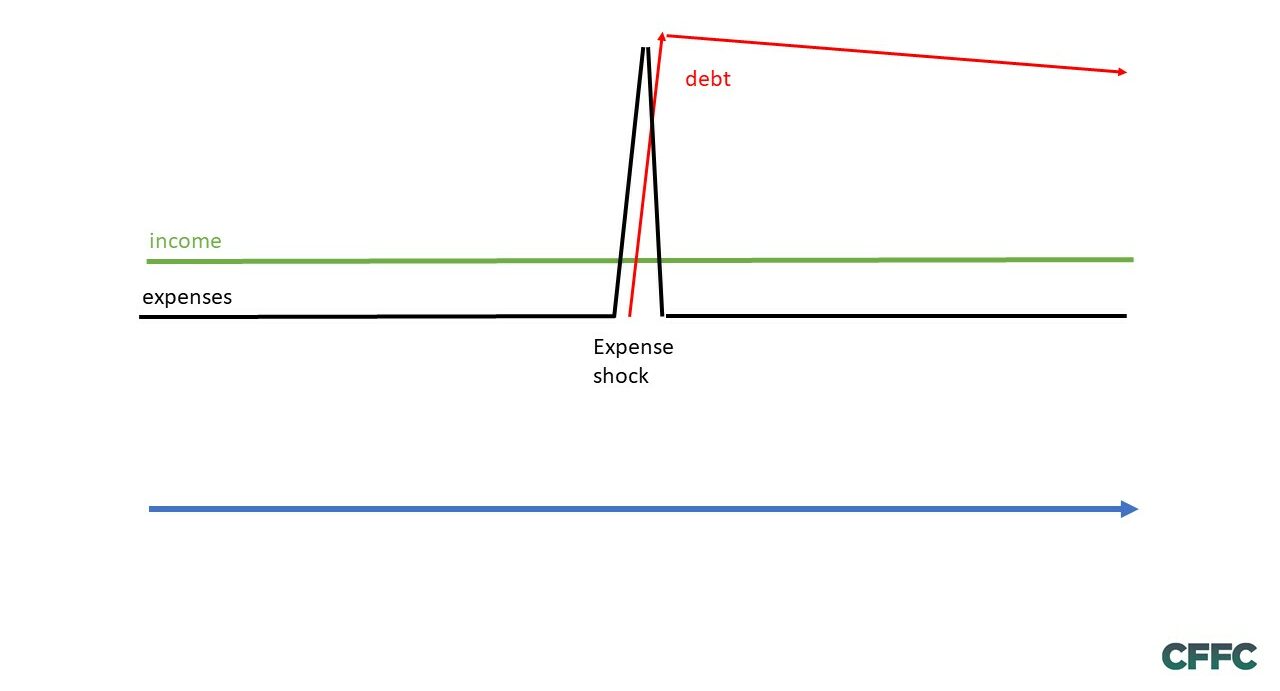

Expense shock debt

Expense shock happens when you need to urgently pay for something that is impossible to refuse.

It could be a sudden illness that has an expensive treatment, a natural disaster, theft, helping a family member, legal problems or bringing home someone stranded by Covid.

Research by Te Ara Ahunga Ora Retirement Commission found that people who experience expense shock don’t seek support due to a belief in self-sufficiency and fear of being judged – particularly if there are cultural differences.

These barriers result in trying to handle stressful and unmanageable costs on your own and using readily available high-interest loans without knowing all your options.

A sudden shock and the added stress of the life event puts you at risk of unmanageable debt, particularly if you have borrowed money that has no wiggle room for mistakes.

What to do if you experience an expense shock

Speak to one of our team members about whether you are eligible for a Good Loan.

Good Loans are no interest loans for purchasing essential items.

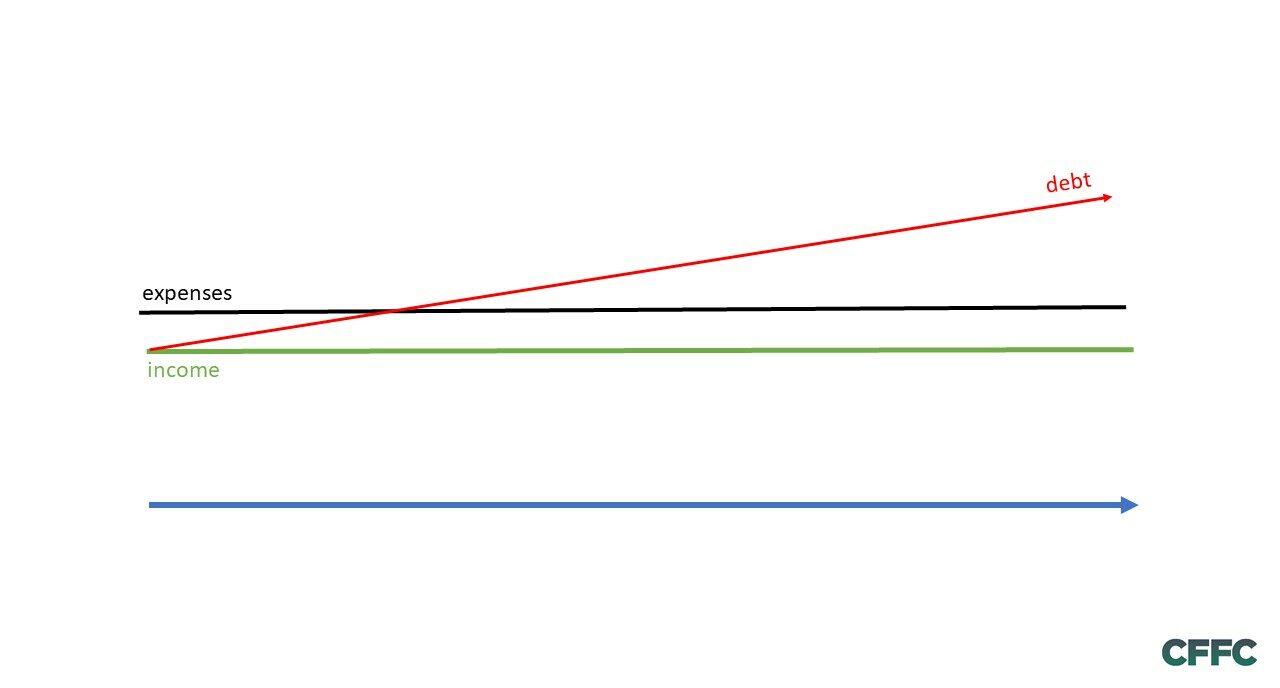

Chronic low income debt

Chronic low income can come down to a number of reasons: health, trauma, care commitments, qualifications or relying on social welfare.

If you’re on a consistently low income that isn’t enough to keep up with the cost of living, you may need to borrow money to meet your needs.

Slowly accumulated debt can result in a person feeling like debt is normal and isn’t a problem.

It’s not until the power’s been shut off or the debt collectors knocking at your door, do you realise the harm you’re causing.

Research by Te Ara Ahunga Ora Retirement Commission found that people who are in chronic low income debt, don’t believe there is a solution. There is a feeling of distrust towards authorities and organisations due to past experiences. Plus there are also lifestyle barriers that limit access to an email account, filling out forms and being able to get to appointments.

Your options if you’re experiencing chronic low income

- Use a budgeting tool to see if you can cut down costs.

- Use community loans, like Good Loans, to avoid high-interest loans

- Speak to your community leaders about your available options

- Speak to Work and Income or Money Talks to find out what options are available to you

Conclusion

There are many reasons why someone might end up in debt and sometimes debt is necessary to stay afloat.

However it’s important to make sure you know what options are available to you when taking out a loan to avoid spiralling into unmanageable debt.

This blog was inspired by research into problem debt by Celestyna Galicki from Te Ara Ahunga Ora Retirement Commission.

Click here to read research by Celestyna Galicki – Segments of Problem Debt

What to do if you have unmanageable debt

Our DEBTsolve programme will help you take control of your unmanageable debt.

Our specialist debt coaches will work with you to understand your situation and create a plan that will help you get on top of your debt.

Our free DEBTsolve programme combines debt coaching, advocacy and debt solution loans of up to $10,000 to help with your unmanageable debt.

Related

Eight signs that gambling is no longer just for fun

What to consider when applying for a loan

Creating a budget with your partner

More

What is sexually transmitted debt (STD)?

How Toni took back control of her debt