Connie’s story about getting her life back

I just want to have a good nest egg. I would love to own

my own home. I dream of travelling one day, if I can

squirrel away a little bit of money.

My husband isolated me from friends, family and my

income. He would have the newest phone and the best

shoes but we couldn’t afford formula for the baby.

This is Connie’s story, edited to keep her safe and help you read. Quotes are Connie’s own words. Names have been changed.

When I met James, I had a good job in the medical sector and was living at home with my mum and nana. I was growing my savings.

“I was pottering along and doing well. And, because I was working and living at home at that time, I was saving a lot.”

We met through his family. His sister was a friend of mine and I knew his mum too. He started paying attention to me over time, talking about how great I was. He was a very fun and very popular person, and it was amazing to hear that he felt lucky to have me. I was so excited when we decided to get married. We had the same values and wanted the same things for our future.

Very soon after the wedding James had new ideas for his future. He wanted fewer children than we had talked about, and he said he would be away from home a lot. He had never mentioned this before. Being alone in a relationship would have been a deal breaker for me.

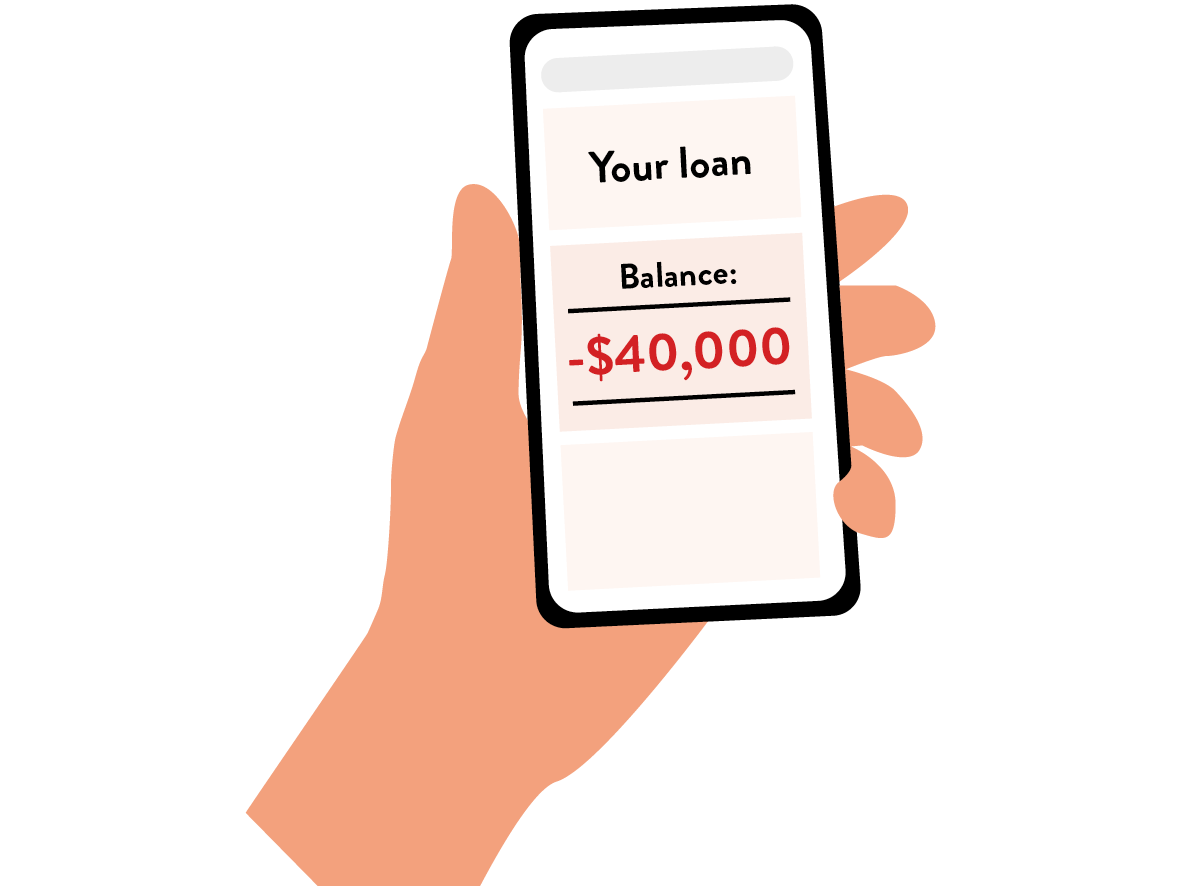

“Within the first six months of being married, I was in debt. It felt like being mugged — like you’ve been stood over by your husband and he’s saying ‘I need your card. I need to take your card’.”

He started to demand money from me. If I hesitated, he would say I wasn’t a good partner and threaten to leave. I found that really difficult because I didn’t want to be a failure.

In the early days of our marriage, I had a good job and a healthy savings account. When we had our first child, I stopped working so I could take care of the baby. As my money dried up, my husband started to take out credit — in my name. Any debt was taken on in my name. I knew this and I signed on to things because if I didn’t, he would get angry and scream or do things like driving dangerously on purpose when me and the baby were in the car.

“It’s so much easier to give in than to go through whatever is going to happen to you from saying no.”

We both went on the benefit after I stopped working. Half of the money coming in went into my account and half went into his. He expected my half to cover our rent and anything the children needed. He would have the newest phone and nice shoes, and I didn’t have money to put credit on my old phone or buy formula for the baby. His family noticed the differences in how we were living, and they would sometimes give money to me or the kids. My parents help me out too, paying for appointments or clothes for the children.

I think this family support was part of why he insisted we move to Australia. The physical and economic abuse got much worse when we moved to Darwin. I wasn’t allowed to call my family.

“Basically, he was like ‘I will destroy you. No one will ever want you. I’ll make sure you have no relationships and I’m not going to stop until you kill yourself’.”

In the wake of the marriage, I was left with masses of debt, including an overdraft and credit-related bills that I just couldn’t budge. My ex-husband is working but gets paid under the table, so he doesn’t have to report his earnings or pay child support.

The stress caused by the debt has been huge. It was feeling totally unmanageable until I learned about Good Shepherd. They helped me get an overdraft wiped, got my debt consolidated, and offered me an affordable loan so I can pay things off slowly.

My main goal is to get back to the life I was living before I met my ex. Ever since we were married, I have lived in poverty, which wasn’t the case before. I’m in a support group with women who have been through similar experiences. I keep telling them, and myself, that we just have to get through this. It’s scary but I know things will be better.

“Even though I’m so much better off than when I was with him, I’m still not out of that hole he dug for me because I don’t have any savings. I hope one day that will change.”