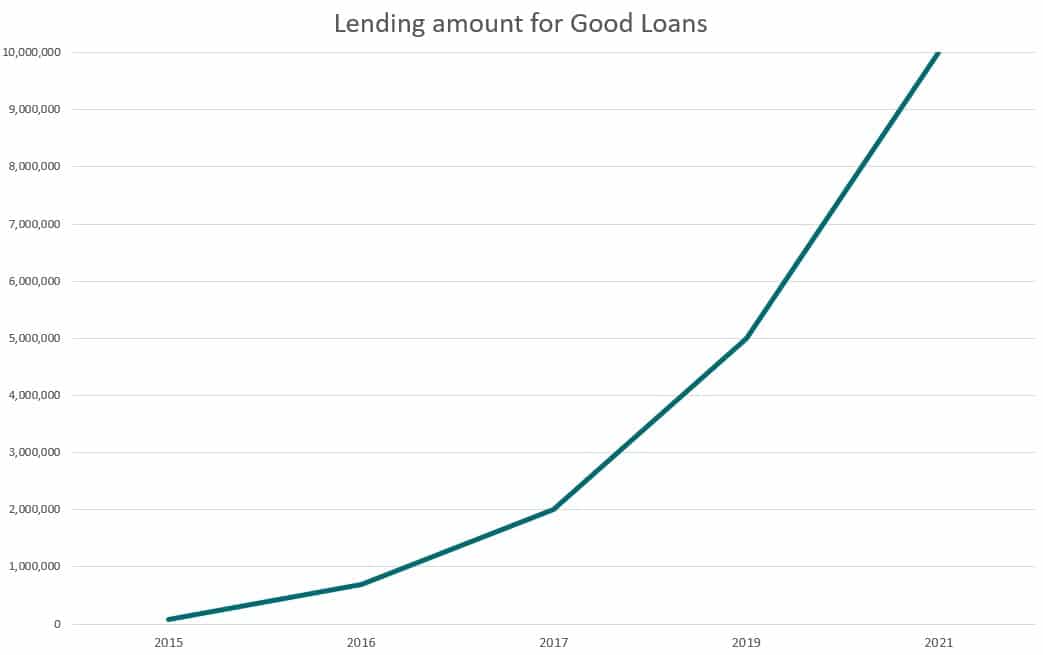

Good Loans hits ten million dollars in lending

September 20, 2021

Kiwis have saved an estimated five million dollars in interest and fees through Good Shepherd NZ and BNZ’s Good Loans programme, compared to if they’d borrowed from high-cost lenders.

The programme, which is also supported by MSD, is centred around clients’ long-term financial wellbeing.

Good Loans has supported Kiwis who are financially struggling, by providing over ten million dollars in no and low interest loans and by helping clients gain the skills and knowledge they need to build on their financial capabilities.

When clients apply for a Good Loan, they’ll team up with their Community Loan Worker to review their personal financial situation.

The Community Loan Worker will support the client to better understand their income and expenses, apply for a loan where appropriate and access the various support available to them.

Good Loans also improves clients’ wellbeing, by enabling them to buy the essential item or service they need – without the risk of high interest or default fees.

Good Shepherd NZ’s Chief Executive Fleur Howard said:

“Our Good Loans programme provides more than just a fair and affordable loan. It helps our clients access a service or item that improves their day-to-day life, and it builds their financial confidence so they can make better informed financial choices in the future.”

The impact

Since the programme launched seven years ago, the demand for Good Loans in communities has continued to grow.

So far Good Loans has helped clients purchase around:

furniture items

car repairs

devices

house maintenance jobs

medical bills

second-hand cars

Cars give our clients their freedom and independence.

They no longer need to rely on public transport, which can often be scarce if they live away from main transport routes.

Cars also enable them to stay connected to their families and communities, and they’re able to improve their employment options because they can apply for jobs that:

require a car

are further away

have shifts outside of the public transport schedule

Client stories

Aroha

Julie

For Julie, Good Loans was a second chance.

She said:

“Someone had given me a chance and said yes to my loan. It had been so long since I’d experienced a positive like that.

“It was the kindness that I learned about during the Good Loans process. I wasn’t judged for my experiences, I wasn’t judged for being in an abusive relationship and wasn’t judged for having been in prison.

"For me, Good Loans was a second chance.”

Good Loans is designed to support people who might be struggling financially and have exhausted other options. It provides them with a fair and affordable loan option and is focused on them and their long-term financial wellbeing.

Fleur said:

“This ten million dollar milestone is really exciting. When we started the programme that seemed a long way off, but now we know there’s an additional ten million dollars out there helping our clients.

“Thank you BNZ and MSD, and our community partners, for that. We hear from our clients about how Good Loans has made a positive difference in their lives. That motivates us to keep growing the programme so we can continue to support those in our community who are struggling.”

Good stories:

How Toni took back control of her debt

How can I make a difference as a Tongan?