Cross-sector commitment shown at International Economic Abuse Awareness Day event

“While trying to recover emotionally and rebuild life as a single mum, I also had to deal with the financial damage he caused…” Good Shepherd NZ client, Katy*

International Economic Abuse Awareness Day is an opportunity to call for greater recognition of the harm caused by economic abuse and the need for solutions. This year, Good Shepherd NZ partnered to meaningfully contribute to those lasting solutions, creating a new code of practice for specialist lenders with the Financial Services Federation (FSF).

Good Shepherd NZ and FSF gathered people working in the financial services, community and private sectors at an event in Auckland to mark the Awareness Day and launch the code. Good Shepherd NZ Chief Executive Tania Pouwhare introduced leaders working to raise awareness of economic abuse and address the conditions that allow it to happen.

Equal Employment Opportunities Commissioner, Gail Pacheco spoke of the difference the code of practice can make on the lives of those experiencing economic abuse, and of economic abuse as a human rights issue. Systemic issues, like the gender-pay-gap and unequal labour market outcomes, also hold women back and hinder financial recovery.

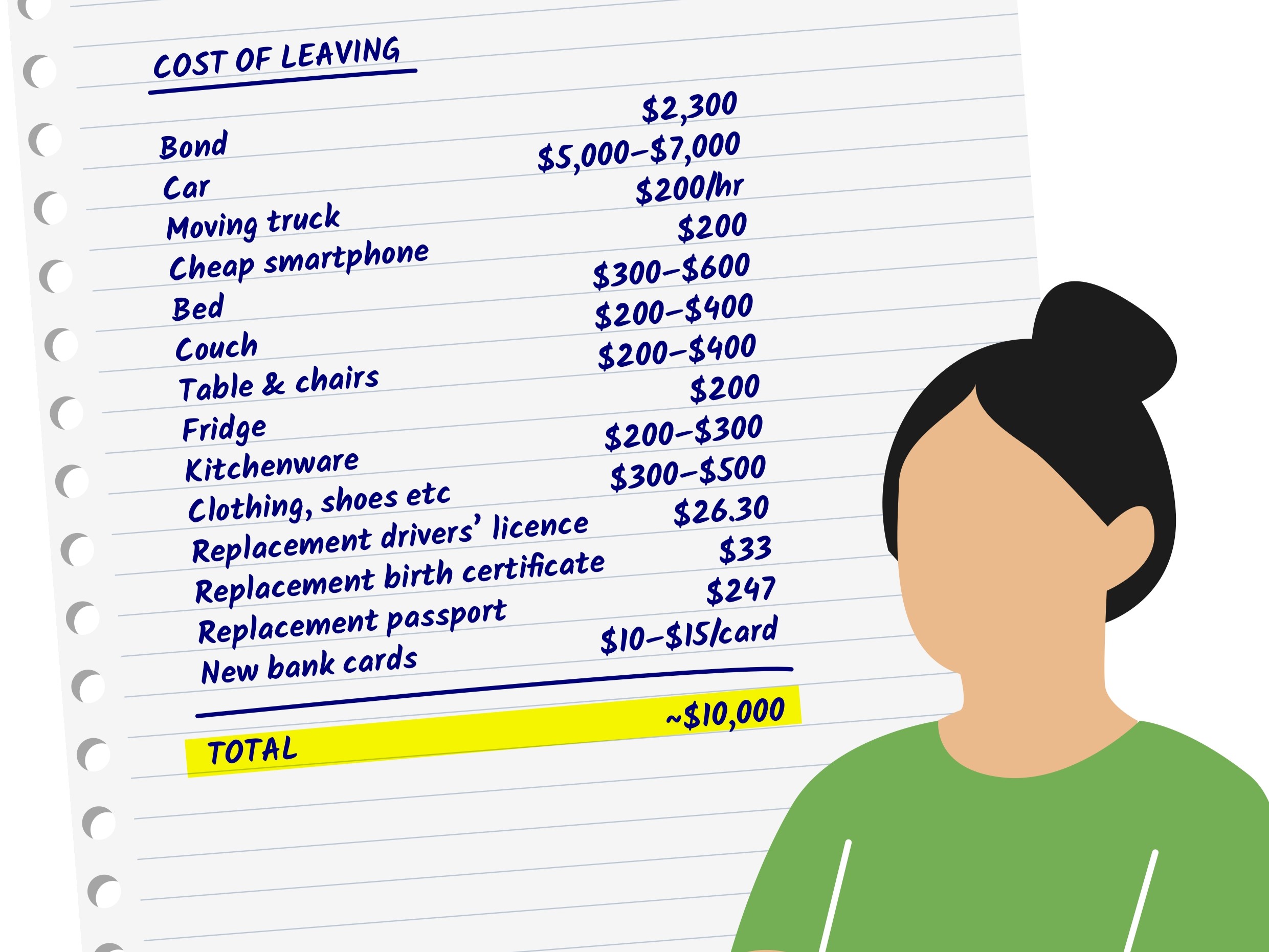

Good Shepherd NZ’s Senior Family Violence Specialist, Vanessa Mazzola, shared the story of a client she had supported. Katy had left a violent relationship with her young child but was struggling to financially recover due to debt that was taken out in her name without her knowledge.

“Around two years ago, he decided to purchase a brand-new car and arranged an $80,000 loan through UDC Finance. What I didn’t know then was that he had taken out the entire loan in my name, without my knowledge or consent. He used my passport ID and even forged my signature. All the paperwork went to his email, so I didn’t know anything about it until much later.”

Vanessa shared how she was able to work with UDC Finance to get Katy’s name taken off the debt for the car loan, relieving the constant anxiety this was causing. We want to extend our sincere thanks to Katy for sharing her story and for taking the time to attend our event. Her story helped those in the room understand the true impact that financial services, and other essential service providers, can make when they understand economic abuse and the harm it can cause.

Don Atkinson, UDC Finance, shared a financial service provider’s perspective on the code of practice. He spoke of Katy’s story providing the ‘why’ for financial services adopting the code of practice, and that the guidance gave clear examples of ‘how’ they could operationalise these in practice.

“A real responsibility for us, is to pick this code up, turn the words on the page into action and the culture within the organisation itself” Don Atkinson, UDC Finance

Professor Janet Fanslow of the University of Auckland provided more context on the scale and prevalence of economic abuse in New Zealand. Her insights drew from her research into the impacts of it on women’s mental health and financial wellbeing. The research found that 15% of women in New Zealand have experienced economic abuse. She also reported a stark statistic that those who experienced it were almost five times more likely to report a mental health condition.

Lyn McMorran, Executive Director of FSF, rounded off the event with her reflections on the development of the code of practice and the opportunities it provides their member organisations.

“Giving [our members] the guidance in terms of the ways in which they can bring those principles to life, I think is really invaluable” Lyn McMorran, Financial Services Federation

We want to thank all the speakers for their valuable insights and for making the time to attend the event. The release of the code of practice shows the impact we can make when we collaborate across sectors. The event provided a chance to bring together people from a range of backgrounds with a shared focus on addressing critical issues. Good things always come when we share perspectives and strengthen our collective response.

“I can now focus on rebuilding my life and creating a safe, stable home for my daughter.”

*name changed for safety