Research: Housing challenges of older women living alone

This report brings together the voices and experiences of older women who are living with housing stress or on low incomes, and the support that helps them stay well.

We conducted research with a small number of women aged 57-83, who described the challenges they face and the strength and resourcefulness they draw on to manage them.

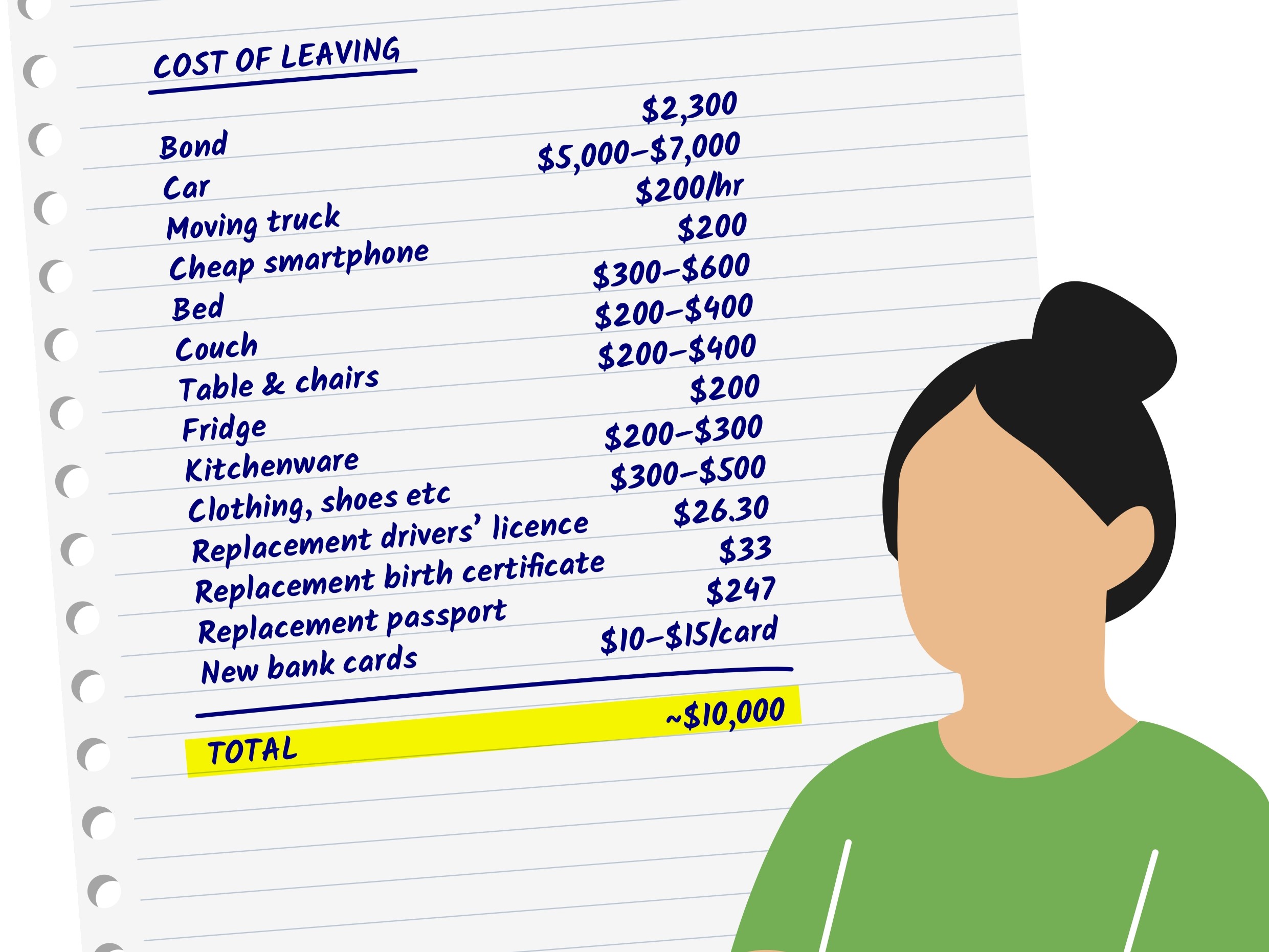

For many, housing challenges are shaped not only by limited income, but by lifetime patterns of low pay, caregiving, disability, racism, migrant experiences and the long-term effects of trauma. These overlapping and intersecting factors influence how older women access and maintain housing and how they experience the systems around them.

The insights shared in this research report offer a clear picture of what secure housing looks like for older women, the barriers that get in the way, and the opportunities to support women to age in place with stability, dignity and connection.

We outline principles, findings and opportunities for Good Shepherd, other social service organisations, and government agencies to address these challenges.